Michael Burry, the notable figure from “The Big Short,” made bearish investments against the S&P 500 and Nasdaq-100 during the previous quarter. He also shifted his focus from Chinese e-commerce giants and struggling banks to investments in shipping, mining, and energy enterprises.

According to a filing with the Securities and Exchange Commission released on Monday, Burry held put options on two major index funds, namely SPDR S&P 500 and Invesco QQQ, by the end of June.

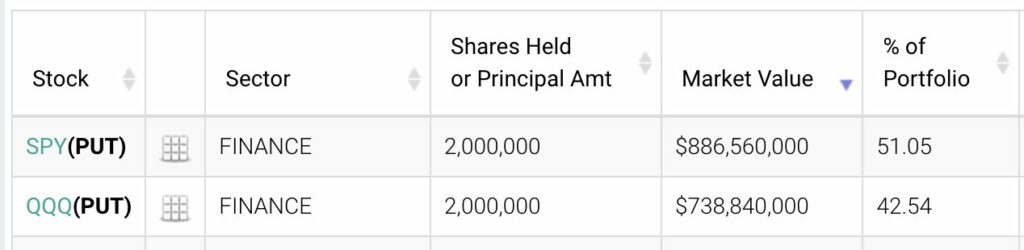

BREAKING 🚨: Michael Burry just shorted the market with $1.6 billion.

Bought $890M of $SPY Puts Bought $740M of $QQQ Puts.

This now makes up 93% of his entire portfolio. pic.twitter.com/7SouQZs5sA

— OnlyOptionsTrades (@OnlyOTrades) August 14, 2023

In the first quarter, Burry had invested in discounted banking stocks, but he subsequently divested from Capital One, First Republic, PacWest Bancorp, Wells Fargo, and Western Alliance.

Scion Asset Management, Burry’s investment firm, also sold its holdings in two Chinese internet giants, Alibaba and JD.com. However, the firm added Crescent Energy, Comstock Resources, Precision Drilling, Star Bulk Carriers, and Stellantis to its investment portfolio.

The only positions that remained unchanged during this period were in Geo Group, Liberty Latin America, New York Community Bancorp, Signet Jewelers, Cigna Group, and The RealReal.

Despite these changes, the overall value of Scion’s portfolio remained relatively stable at $111 million, excluding options.

Michael Burry gained prominence for his significant bet against the mid-2000s housing bubble, a story featured in “The Big Short.” He’s also recognized for his involvement with GameStop before it gained meme stock status, as well as his short positions against Tesla and Cathie Wood’s flagship Ark Innovation fund.

Burry is known for his grim warnings about asset bubbles and predictions of major market crashes. He notably issued a succinct “Sell” declaration at the end of January, which he later admitted was mistaken in March. He has since maintained a low profile on social media. However, Burry posts frequently to X.com, only to delete the posts shortly after.